By Ernest Chan, Ph.D., Haoyu Fan, Ph.D., Sudarshan Sawal, and Quentin Viville, Ph.D.

Previously on this blog, we wrote about a machine-learning-based parameter optimization technique we invented, called Conditional Parameter Optimization (CPO). It appeared to work well on optimizing the operating parameters of trading strategies, but increasingly, we found that its greatest power lies in its potential to optimize portfolio allocations. We call this Conditional Portfolio Optimization (which fortuitously shares the same acronym).

Let’s recap what Conditional Parameter Optimization is. Traditionally, optimizing the parameters of any business process (such as a trading strategy) is a matter of finding out what parameters give an optimal outcome over past data. For example, setting a stop loss of 1% gave the best Sharpe ratio for a trading strategy backtested over the last 10 years. Or running the conveyor belt at 1m per minute led to the lowest defect rate in a manufacturing process. Of course, the numerical optimization procedure can become quite complicated based on a number of different factors. For example, if the number of parameters is large, or if the objective function that relates the parameters to the outcome is nonlinear, or if there are numerous constraints on the parameters. There are already standard methods to handle these difficulties.

What concerns us at PredictNow.ai, is when the objective function is not only nonlinear, but also depends on external time varying and stochastic conditions. In the case of a trading strategy, the optimal stop loss may depend on the market regime, which may not be clearly defined. In the case of a manufacturing process, the optimal conveyor belt rate may depend on dozens of sensor readings. Such objective functions mean that traditional optimization methods do not usually give the optimal results under a particular set of external conditions.Furthermore, even if you specify that exact set of conditions, the outcome is not deterministic. What better method than machine learning to solve this problem!

By using machine learning, we can approximate this objective function using a neural network, by training its many nodes using historical data. (Recall that a neural network is able to approximate almost any function, but you can use many other machine learning algorithms instead of neural networks for this task). The inputs to this neural network will not only include the parameters that we originally set out to optimize, but also the vast set of features that measure the external conditions. For example, to represent a “market regime”, we may include market volatility, behaviors of different market sectors, macroeconomic conditions, and many other input features. To help our clients efficiently run their models, Predictnow.ai provides hundreds of such market features. The output of this neural network would be the outcome you want to optimize. For example, maximizing the future 1-month Sharpe ratio of a trading strategy is a typical outcome. In this case you would feed historical training samples to the neural network that include the trading parameters, the market features, plus the resulting forward 1-month Sharpe ratio of the trading strategy as “labels” (i.e. target variables). Once trained, this neural network can then predict the future 1-month Sharpe ratio based on any hypothetical set of trading parameters and the current market features.

With this method, we “only need” to try different sets of hypothetical parameters to see which gives the best Sharpe ratio and adopt that set as the optimal¹. We put “only need” in quotes because of course if the number of parameters is large, it can take very long to try out different sets of parameters to find the optimal. Such is the case when the application is portfolio optimization, where the parameters represent the capital allocations to different components of a portfolio. These components could be stocks in a mutual fund, or trading strategies in a hedge fund. For a portfolio that holds S&P 500 stocks, for example, there will be up to 500 parameters. In this case, during the training process, we are supposed to feed into the neural network all possible combinations of these 500 parameters, plus the market features, and find out what the resulting 5- or 20-day return, or Sharpe ratio, or whatever performance metric we want to maximize. All possible combinations? If we represent the capital weight allocated to each stock as w ∈ [0, 1], assuming we are not allowing short positions, the search space has w^500=[0, 1]^500 combinations, even with discretization, and our computer will need to run till the end of the universe to finish. Overcoming this curse of dimensionality is one of the major breakthroughs the Predictnow.ai team has accomplished with Conditional Portfolio Optimization.

To measure the value Conditional Portfolio Optimization adds, we need to compare it with alternative portfolio optimization methods. The default method is Equal Weights: applying equal capital allocations to all portfolio components. Another simple method is the Risk Parity method, where the capital allocation to each component is inversely proportional to its returns’ volatility. It is called Risk Parity because each component is supposed to contribute an equal amount of volatility, or risk, to the overall portfolio’s risk. This assumes zero correlations among the components’ returns, which is of course unrealistic. Then there is the Markowitz method, also known as Mean-Variance optimization. This well-known method, which earned Harry Markowitz a Nobel prize, maximizes the Sharpe ratio of the portfolio based on the historical means and covariances of the component returns. The optimal portfolio that has the maximum historical Sharpe ratio is also called the tangency portfolio. I wrote about this method in a previous blog post. It certainly doesn’t take into account market regimes or any market features. It is also a vagrant violation of the familiar refrain, “Past Performance is Not Indicative of Future Results”, and is known to produce all manners of unfortunate instabilities (see here or here). Nevertheless, it is the standard portfolio optimization method that most asset managers use. Finally, there is the Minimum Variance portfolio, which uses Markowitz’s method not to maximize the Sharpe ratio, but to minimize the variance (and hence volatility) of the portfolio. Even though this does not maximize its past Sharpe ratio, it often results in portfolios that achieve better forward Sharpe ratios than the tangency portfolio! Another case of “Past Performance is Not Indicative of Future Results”.

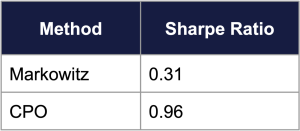

Let’s see how our Conditional Portfolio Optimization method stacks up against these conventional methods. For an unconstrained optimization of the S&P 500 portfolio, allowing for short positions and aiming to maximize its 7-day forward Sharpe ratio,

(These results are over an out-of-sample period from July 2011 to June 2021, and the universe of stocks for the portfolio are those that have been present in the SP 500 index for at least 1 trailing month. The Sharpe Ratio we report in this and the following tables are all annualized). CPO improves the Sharpe ratio over the Markowitz method by a factor of 3.1.

Then we test our CPO performs for an ETF (TSX: MESH) given the constraints that we cannot short any stock, and the weight w of each stock obeys w ∈ [0.5%, 10%],

CPO performed similarly to the Markowitz method in the bull market, but remarkably, it was able to switch to defensive positions and has beaten the Markowitz method in the bear market of 2022. It improves the Sharpe ratio over the Markowitz portfolio by more than 60% in that bear market. That is the whole rationale of Conditional Portfolio Optimization – it adapts to the expected future external conditions (market regimes), instead of blindly optimizing on what happened in the past.

Next, we tested the CPO methodology on a private investor’s tech portfolio, consisting of 7 US and 2 Canadian stocks, mostly in the tech sector. The constraints are that we cannot short any stock, and the weight w of each stock obeys w ∈ [0%, 25%],

CPO performed better than both alternative methods under all market conditions. In particular, it improves the Sharpe ratio over the Markowitz portfolio by 75% in the bear market.

We also tested how CPO performs for some unconventional assets – a portfolio of 8 crypto currencies, again allowing for short positions and aiming to maximize its 7-day forward Sharpe ratio,

(These results are over an out-of-sample period from January 2020 to June 2021, and the universe of cryptocurries for the portfolio are BTCUSDT, ETHUSDT, XRPUSDT, ADAUSDT, EOSUSDT, LTCUSDT, ETCUSDT, XLMUSDT). CPO improves the Sharpe ratio over the Markowitz method by a factor of 3.8.

Finally, to show that CPO doesn’t just work on portfolios of assets, we apply it to a portfolio of FX trading strategies traded live by a proprietary trading firm WSG. It is a portfolio of 7 trading strategies, and the allocation constraints are w ∈ [0%, 40%],

(These results are over an out-of-sample period from January 2020 to July 2022). CPO improves the Sharpe ratio over the Markowitz method by 19%.

In all 5 cases, CPO was able to outperform the naive Equal Weights portfolio and the Markowitz portfolio during a downturn in the market, while generating similar performance during the bull market.

For clients of our CPO technology, we can add specific constraints to the desired optimal portfolio, such as average ESG rating, maximum exposure to various sectors, or maximum turnover during portfolio rebalancing. The only input we require from them is the historical returns of the portfolio components (unless these components are publicly traded assets, in which case clients only need to tell us their tickers). Predictnow.ai will provide pre-engineered market features that capture market regime information. If the client has proprietary market features that may help predict the returns of their portfolio, they can merge those with ours as well. Clients’ features can remain anonymized. We will be providing an API for clients who wish to experiment with various constraints and their effects on the optimal portfolio.

If you’d like to learn more, please join us for our Conditional Portfolio Optimization webinar on Thursday, October 22, 2022, at 12:00 pm New York time. Please register here.

In the meantime, if you have any questions, please email us at info@predictnow.ai.

¹Some traders may object that if a neural network can predict a strategy’s or a portfolio’s Sharpe ratio based on its parameters and market features, why not use the network to directly predict the underlying assets’ returns and dispense with the original strategy? One reason is that it is easier to predict a strategy’s or a portfolio’s returns instead of a public asset’s return, because even if many people can predict a strategy’s returns successfully, it will not suffer alpha decay unless you know what the precise strategy is. Another reason is that in optimization, you don’t really need to predict the return accurately – you just need to predict which set of parameters give the best returns. Even if the returns predictions come with huge error bars, it is the ordinality of predicted returns that matters.